====== 165 ======

Submitted byDouglas J. ChuHynes & Chu LLP Attachment f: Reprinted with permission from New York Legal Assistance Group. Attachment g: Reprinted with permission. ICAN is a program of the Community Service Society of New York, funded by New York State. The opinions, results, findings, and/or interpretations of data contained in this brochure are the responsibility of CSS and do not necessarily represent the opinions, interpretations or policy of the State. Attachments h–l: The information and materials are published with the permission of the Human Resources Administration of the City of New York. Copyright 2016, The City of New York, Department of Social Services. If you find this article helpful, you can learn more about the subject by going to www.pli.edu to view the on demand program or segment for which it was written. |

====== 167 ======

SPECIAL STANDARDS FOR HOUSING EXPENSES | |||||

|---|---|---|---|---|---|

REGION | Amount | REGION | Amount | REGION | Amount |

Central | $412 | Northeastern | $471 | Northern Metropolitan | $892 |

Rochester | $419 | Long Island | $1,285 | ||

Western | $367 | New York City | $1,171 | ||

*In determining the community resource allowance on and after January 1, 2016, the community spouse is permitted to retain resources in an amount equal to the greater of the following $74,820 or the amount of the spousal share up to $120,900. The spousal share is the amount equal to one-half of the total value of the countable resources of the couple as of the beginning of the most recent continuous period of institutionalization of the institutionalized spouse on or after September 30, 1989.

Revised December 6, 2016

====== 168 ======

====== 169 ======

Revised October 19, 2016

====== 170 ======

====== 171 ======

The purpose of this General Information System (GIS) message is to advise local departments of social services (LDSS) of the levels and figures used in determining Medicaid eligibility effective January 1, 2017.

Due to a 0.3 percent cost of living adjustment (COLA) for Social Security Administration (SSA) payments effective January 1, 2017, several figures used in determining Medicaid eligibility must be updated. Since the increase to the Supplemental Security Income (SSI) benefit levels was relatively small, the Medically Needy Income and Resource Levels will remain the same.

Due to the low COLA and a statutory “hold harmless” provision designed to ensure that a beneficiary’s Social Security benefit is not lower in January than it was in December due solely to the increase in Medicare Part B premiums, Medicare Part B premiums will vary depending on the amount of an individual’s Social Security benefit in 2017. Medicare Part B premiums will increase by the amount of the individual’s Social Security COLA. The net result of the COLA increase for many Medicaid recipients will be a $0 change in net available monthly income.

Since information concerning the manner in which Medicare Part B premiums would be impacted by the COLA was not received in time to make the necessary changes for the scheduled Mass Re-Budgeting (MRB) upstate, it was decided not to perform the MRB. While the MRB will not occur, the MBL tables and figures will be updated to reflect the 2017 figures. The updated MBL tables for upstate will be available December 5, 2016 and for New York City on December 9, 2016.

A chart with the new Medicaid levels is attached. MBL will be programmed to use these figures when a “From” date of January 1, 2017, or greater is entered.

Note: Budgets with a “From” date of January 1, 2017, or later, that utilize an FPL, must be calculated with the 2016 Social Security benefit amount and Medicare Part B premium until the 2017 FPLs are available on MBL. Upstate districts should separately identify these cases for re-budgeting once the 2017 FPLs are available as these cases will not be included in Phase Two of Mass Re-budgeting. In New York City, the 2016 Social Security benefit amounts and Part B premium should be used until Phase Two of Mass Re-budgeting. Upstate districts are instructed to update Social Security benefit amounts and Medicare Part B premiums for budgets that do not utilize a FPL at next contact or recertification, whichever occurs first.

====== 172 ======

The following figures are effective January 1, 2017.

1. | Medically Needy Income and Resources Levels.

| |||||||||||||||||||||||||||||||||||||||||||||||||||

2. | The Supplemental Security Income federal benefit rate (FBR) for an individual living alone is $735/single and $1,103/couple. | |||||||||||||||||||||||||||||||||||||||||||||||||||

3. | The allocation amount is $384, the difference between the Medicaid income level for a household of two and one. | |||||||||||||||||||||||||||||||||||||||||||||||||||

4. | The 249e factors are .968 and .159. | |||||||||||||||||||||||||||||||||||||||||||||||||||

5. | The SSI resource levels remain $2,000 for individuals and $3,000 for couples. | |||||||||||||||||||||||||||||||||||||||||||||||||||

6. | The State Supplement is $87 for an individual and $104 for a couple living alone. | |||||||||||||||||||||||||||||||||||||||||||||||||||

7. | The Medicare Part A Hospital Insurance Base Premium is $227/month for people having 30-39 work quarters and $413/month for people who are not otherwise eligible for premium-free hospital insurance and have less than 30 quarters. The standard Medicare Part B monthly premium for beneficiaries with income less than or equal to $85,000 is $134. | |||||||||||||||||||||||||||||||||||||||||||||||||||

8. | The Maximum federal Community Spouse Resource Allowance is $120,900. | |||||||||||||||||||||||||||||||||||||||||||||||||||

9. | The Minimum State Community Spouse Resource Allowance is $74,820. | |||||||||||||||||||||||||||||||||||||||||||||||||||

10. | The community spouse Minimum Monthly Maintenance Needs Allowance (MMMNA) is $3,022.50. | |||||||||||||||||||||||||||||||||||||||||||||||||||

11. | Maximum Family Member Allowance is $668 until the FPLs for 2017 are published in the Federal Register. | |||||||||||||||||||||||||||||||||||||||||||||||||||

12. | Family Member Allowance formula number remains $2,003 until the FPLs for 2017 are published in the Federal Register. | |||||||||||||||||||||||||||||||||||||||||||||||||||

13. | Personal Needs allowance for certain waiver participants subject to spousal impoverishment budgeting is $384. | |||||||||||||||||||||||||||||||||||||||||||||||||||

14. | Substantial Gainful Activity (SGA) is: Non-Blind $1,170/month, Blind $1,950/month and Trial Work Period (TWP) $840/month. | |||||||||||||||||||||||||||||||||||||||||||||||||||

15. | SSI-related student earned income disregard limit of $1,790/monthly up to a maximum of $7,200/annually. | |||||||||||||||||||||||||||||||||||||||||||||||||||

16. | The home equity limit for Medicaid coverage of nursing facility services and community-based long-term care is $840,000. | |||||||||||||||||||||||||||||||||||||||||||||||||||

17. | The special income standard for housing expenses that is available to certain individuals who enroll in the Managed Long Term Care program (See 12 OHIP/ADM-5 for further information) vary by region. For 2017, the amounts are: Northeastern $471; Central $412; Rochester $419; Western $367; Northern Metropolitan $892; Long Island $1,285; and New York City $1,171. | |||||||||||||||||||||||||||||||||||||||||||||||||||

Please direct any questions to the Local District Support Unit at 518-474-8887 for Upstate and 212-417-4500 for NYC.

====== 173 ======

Office of Health Insurance Programs

Division of Long Term Care

MLTC Policy 16.06: Guidance on Notices Proposing to Reduce or Discontinue Personal Care Services or Consumer Directed Personal Assistance Services

Date of Issuance: November 17, 2016

On December 30, 2015, the Department notified all managed long term care (“MLTC”) plans of recent changes to the Department’s regulations governing personal care services (“PCS”) and consumer directed personal assistance (“CDPAS”), including revised regulatory provisions governing notices that deny PCS or CDPAS or propose to reduce or discontinue PCS or CDPAS. (See MLTC Policy 15.09 at http://www.health.ny.gov/health_care/medicaid/redesign/mltc_policy_15-09.htm.).

The purpose of this directive is to provide further guidance to MLTC plans concerning appropriate reasons and notice language to be used when proposing to reduce or discontinue PCS or CDPAS. In particular, it addresses notices that propose to reduce or discontinue PCS or CDPAS for either of the following reasons: a change in the enrollee’s medical or mental condition or social circumstances; or a mistake that occurred in the previous authorization or reauthorization.

A MLTC plan may not reduce or discontinue an enrollee’s PCS or CDPAS unless there is a legitimate reason for doing so, such as one of the reasons set forth in 18 NYCRR §§ 505.14(b)(5)(v)(c)(2)(i) through (vi), for PCS, and 18 NYCRR §§ 505.28(h)(5)(ii)(a) through (f), for CDPAS. Two such examples are discussed in greater detail below. The MLTC plan must advise the enrollee of the specific reason for the proposed action. A plan cannot reduce or discontinue services without considering the facts of the individual enrollee’s circumstances and thus cannot reduce services as part of an “across-the-board” action that does not consider each individual enrollee’s particular circumstances and need for assistance.

The general purpose of these requirements is to assure that the plan’s notice accurately advises the enrollee, in plain comprehensible language, what the plan is proposing to change with regard to the enrollee’s PCS or CDPAS and why the plan is proposing to make that change. The more specificity the plan’s notice provides with regard to the specific change in the enrollee’s services, the reason for the change, and why the prior services are no longer needed, the better able the plan will be to defend its proposed reduction or discontinuance at any fair hearing, at which the plan bears the burden of proof to support its proposed action (i.e. the plan must establish that its proposed reduction or discontinuance is correct).

A. Change in Enrollee’s Medical or Mental Condition or Social Circumstances

In such a case, the Plan’s notice must indicate:

====== 174 ======

| • | The enrollee’s medical or mental condition or social circumstances have changed and the plan determines that the services provided under the last authorization or reauthorization are no longer appropriate or can be provided in fewer hours. If the reason for the proposed reduction or discontinuance is a change in one or more such conditions or circumstances, the plan’s notice must not simply recite the underlined language in the previous sentence, which would impermissibly make it the enrollee’s responsibility to figure out which particular condition or circumstance had changed. Such boilerplate recitations are inadequate. Instead, the plan’s notice must: 1) state the enrollee’s particular condition or circumstance - whether medical condition, mental condition, or social circumstance - that has changed since the last assessment or authorization; 2) identify the specific change that has occurred in that particular medical or mental condition or social circumstance since the last assessment or authorization; and 3) state why the services should be reduced or discontinued as a result of that change in the enrollee’s medical or mental condition or social circumstances. Example of a change in medical condition: The plan authorized an enrollee for personal care services. At the time of the assessment, the enrollee was recuperating from hip replacement surgery. As the enrollee recovered from her surgery, her medical condition improved. Specifically, the enrollee’s hip has now healed sufficiently that she is now able to walk 30 feet alone. The physician’s order documented this improvement in her medical condition. Due to the improvement in her medical condition, she no longer needs the previously authorized level and amount of assistance with personal care services. Accordingly, the enrollee no longer needs help ambulating inside her apartment. Example of a change in social circumstances: The plan had authorized an enrollee for Level II personal care services, support with dressing. At the time of the initial authorization, the enrollee lived in her longtime residence with no family or friends who could help dress and undress. Her sister then moved next door and agreed to help with this task. Due to the change in the enrollee’s social supports, she no longer needs the previously authorized amount of assistance for dressing and undressing. |

====== 175 ======

B. Mistake

In such a case, the Plan’s notice must indicate:

| • | A mistake occurred in the previous PCS or CDPAS authorization or reauthorization. The plan’s notice must identify the specific mistake that occurred in the previous assessment or reauthorization and explain why the prior services are not needed as a result of the mistake. Plans must adhere to the following guidelines when proposing to reduce or discontinue services based on a mistake that occurred in the previous assessment or reassessment: 1) A mistake in a prior authorization or reauthorization is a material error that occurred when the prior authorization was made. An error is a material error when it affected the PCS or CDPAS that were authorized at that time. Example of a mistake: The plan authorized, among other services, assistance with the Level I task of doing the enrollee’s laundry. This authorization, however, was based on an erroneous understanding that the enrollee’s apartment building did not have laundry facilities and that the aide would need to go off-site to do the enrollee’s laundry. During a subsequent assessment, it was determined that the aide did, in fact, have access to a washer and dryer in the basement of the enrollee’s apartment building. The plan thus proposed to reduce the time needed for the aide to perform the enrollee’s laundry to correct the prior mistake and reflect that less time is needed to complete this task than was previously thought. 2) This particular reason for reducing or discontinuing services is intended to allow an MLTC to rectify a material error made in a previous authorization for a particular enrollee. It must not be expanded beyond that narrow application or otherwise used as a reason to reduce services across-the-board or reduce services for a particular enrollee without a legitimate reason as described in this policy directive. For example: • A MLTC plan must not implement a new task-based assessment tool that contains time or frequency guidelines for tasks that are lower than the time or frequency guidelines that were contained in the plan’s previous task-based assessment tool, and then reduce services to an individual or across-the-board on the basis that a “mistake” occurred in the previous authorization. ====== 176 ====== • A MLTC plan must not reduce services when implementing a new task-based assessment tool, if those services were properly contained in the former task-based assessment tool, on the basis that a “mistake” occurred in the previous authorization. 3) A prior authorization for PCS or CDPAS is not a mistake if it was based on the UAS-NY assessment that was conducted at that time but, based on the subsequent UAS-NY assessment, the enrollee is determined to need fewer hours of PCS or CDPAS than were previously authorized. In such a case, a subsequent assessment might support the plan’s determination to reduce or discontinue services for one of the reasons enumerated in NYCRR §§ 505.14(b)(5)(v)(c)(2)(i)-(vi) for PCS and 18 NYCRR §§ 505.28(h)(5)(ii)(a)-(f) for CDPAS. For example: • There has been an improvement in the enrollee’s medical condition since the prior authorization. In such a case, the MLTC plan’s notice must identify the specific improvement in the enrollee’s medical condition and explain why the prior services should be reduced as a result of that change, as set forth above. |

Plans are reminded that enrollees are entitled to timely (i.e. 10 day prior notice) and adequate notice whenever plans propose to reduce or discontinue PCS or CDPAS or other services. All partially capitated plans must also use the State-mandated fair hearing notices. In additions, plans must comply promptly with all aid-continuing directives issued by the NYS Office of Temporary and Disability Assistance.

====== 177 ======

Office of Health Insurance Programs

Division of Long Term Care

MLTC Policy 16.07: Guidance on Task-based Assessment Tools for Personal Care Services and Consumer Directed Personal Assistance Services

Date of Issuance: November 17, 2016

This provides guidance to managed long term care plans regarding the appropriate use of task-based assessment tools for personal care services (PCS) or consumer directed personal assistance services (CDPAS), also commonly referred to as aide task service plans, client-task sheets, or similar names.

A task-based assessment tool typically lists instrumental activities of daily living (IADLs), including but not limited to light cleaning, shopping, and simple meal preparation, and activities of daily living (ADLs), including but not limited to bathing, dressing, and toileting. The tool might also indicate the level of assistance the enrollee requires for the performance of each IADL or ADL. It might also include the amount of time that is needed for the performance of each task or the daily or weekly frequency for that task.

The New York State Department of Health has not approved the use of any particular task-based assessment tool. Nonetheless, managed long term care plans may choose to use such tools as guidelines for determining an enrollee’s plan of care.

If a plan chooses to use a task-based assessment tool, including an electronic task-based assessment tool, it must do so in accordance with the following guidance:

| • | Task-based assessment tools cannot be used to establish inflexible or “one size fits all” limits on the amount of time that may be authorized for an IADL or ADL or the frequency at which such tasks can be performed. Plans must conduct individualized assessments of each enrollee’s need for assistance with IADLs and ADLs. This means that plans must permit the assessments of time, as well as frequency, for completion of a task to deviate from the time, frequency, or other guidelines set forth in the tool whenever necessary to accommodate the enrollee’s individualized need for assistance. |

| • | When an enrollee requires safety monitoring, supervision or cognitive prompting to assure the safe completion of one or more IADLs or ADLs, the task-based assessment tool must reflect sufficient time for such safety monitoring, supervision or cognitive prompting for the performance of those particular IADLs or ADLs. Safety monitoring, supervision and cognitive prompting are not, by themselves, independent or “stand-alone” IADLs, ADLs, or tasks. Ideally, all time that is necessary for the performance of any needed safety monitoring, ====== 178 ====== NOTE: If a plan has previously characterized safety monitoring, supervision or cognitive prompting as an independent, stand-alone task not linked to any IADL or ADL, the plan must not simply delete the time it has allotted for these functions. Rather, the plan must determine whether the time it has allotted for the underlying IADL or ADL includes sufficient time for any needed safety monitoring, supervision or cognitive prompting relating to that particular IADL or ADL and, if not, include all needed time for such functions. Example of supervision and cognitive prompting: A cognitively impaired enrollee may no longer be able to dress without someone to cue him or her on how to do so. In such cases, and others, assistance should include cognitive prompting along with supervision to ensure that the enrollee performs the task properly. |

| • | Plans cannot use task-based assessment tools to authorize or reauthorize services for enrollees who need 24-hour services, including continuous services, live-in 24-hour services, or the equivalent provided by formal services or informal caregivers. The reason for this is that task-based assessment tools generally quantify the amount of time that is determined necessary for the completion of particular IADLs or ADLs and the frequency of that assistance, rather than reflect assistance that may be needed on a more continuous or “as needed” basis, such as might occur when an enrollee’s medical condition causes the enrollee to have frequent or recurring needs for assistance during the day or night. A task-based assessment tool may thus be suitable for use for enrollees who are not eligible for 24-hour services but is inappropriate for enrollees who are eligible for 24-hour care. [See MLTC Policy Directive 15.09, advising plans of recently adopted regulations affecting the eligibility requirements for continuous and live-in 24 hour services as well as revised notice requirements.] |

| • | All plans, including those that use task-based assessment tools, must evaluate and document when and to what extent the enrollee requires assistance with IADLs and ADLs and whether needed assistance can be scheduled or may occur at unpredictable times during the day or night. All plans must assure that the plan of care that is developed can meet any unscheduled or recurring daytime or nighttime needs that the enrollee may have for assistance. The plan must first determine whether the enrollee, because of the enrollee’s medical condition, would be otherwise eligible for PCS or CDPAS, including continuous or live-in 24-hour services. For enrollees who would be otherwise eligible for services, the plan must then determine whether, and the extent to which, the enrollee’s need for assistance can be met by voluntary assistance from informal caregivers, by formal services, or by adaptive or specialized equipment or supplies. For further guidance, please refer to the Department’s prior guidance to social services districts at the following link: ====== 179 ====== |

| • | A task-based assessment tool cannot arbitrarily limit the number of hours of Level I housekeeping services to eight hours per week for enrollees who need assistance with Level II tasks. The eight hour weekly cap on Level I services applies only to persons whose needs are limited to assistance with housekeeping and other Level I tasks. [See Social Services Law § 365-a (2)(e)(iv)]. Persons whose needs are limited to housekeeping and other Level I tasks should not be enrolled in a MLTC plan but should receive needed assistance from social services districts. |

MLTCs must seek approval of task-based assessment tools for personal care services or consumer directed personal assistance services prior to use. Similarly, if an MLTC proposes to modify an existing task-based assessment tool, the MLTC must seek approval of such modification.

Should you have questions regarding this directive, please email the Bureau of Managed Long Term Care at mltcworkgroup@health.ny.gov.

====== 181 ======

====== 183 ======

May 2015, revised Dec. 2016

Explanation of the CFEEC and MLTC Evaluation Process for New Applicants

PART 1 – REQUEST CONFLICT FREE “CFEEC” ASSESSMENT

Now that your client was approved for Community Medicaid with or without a spend down and your client has a CIN #, you or the family has to arrange for the client to be evaluated through the Conflict Free Evaluation and Enrollment Center (CFEEC), run by New York Medicaid Choice or Maximus, a state contractor. Website: https://nymedicaidchoice.com/ask/do-i-qualify-managed-long-term-care. The purpose of this evaluation is for the nurse to determine that your client meets the eligibility criteria for enrollment into a Managed Long term Care.

You may schedule an evaluation before you have been approved for Medicaid but remember that the CFEEC evaluation is only valid for 75 days (increased from 60 days on Dec. 16, 2016). See NYS MLTC Policy 16.08, available at https://www.health.ny.gov/health_care/medicaid/redesign/mrt90/mltc_policy/16-08.htm. If you are not enrolled in an MLTC plan within 75 days of your CFEEC evaluation, then you will have to have another CFEEC evaluation.

What does CFEEC evaluate?

| • | That you require at least 120 days of Community Based Long Term Care Services (CBLTC = Personal care services, CDPAP, Private Duty Nursing etc.). |

| • | The CFEEC evaluation will not determine the number of hours that you qualify for. That step comes later. |

REQUEST CFEEC phone 1-855-222-8350 Monday – Friday 8:30 am to 8:00 pm Saturday 10:00 am to 6:00 pm.

| • | When you call this phone number to arrange for the evaluation through CFEEC, please have the following information about your client:

|

Once you make it through all the prompts, you will speak to a representative at CFEEC and schedule the nurse’s evaluation. The CFEEC representative will ask you and/or remind you of the following:

1. | The evaluation will be about three hours long. |

2. | The evaluation can be done either in the morning or in the afternoon |

3. | Weekend appointments are available but have more limited availability |

4. | Provide instructions for getting to the apartment (nearest subway, doorbell working, any other tips to ensuring access to the apartment/home) |

====== 184 ====== | |

5. | Have your health insurance cards available to show the nurse on the day of the evaluation |

6. | Have all medications accessible to show the nurse |

7. | Have the name and phone number of your primary care physician |

8. | Provide the name and phone number of the individual who should receive a reminder call the day before the evaluation |

During the actual evaluation, it will be important for someone who knows the client to be present because it is critical for someone to explain to the nurse the ways in which the client requires assistance with ADLs (activities of daily living).

1. | Bathing, grooming, dressing, meal preparation, reheating, chores, |

2. | assistance with ambulation (use of a cane or walker, indoor and outdoor) |

3. | transfers (getting up/down from a seated position, getting up/down from a laying position), |

4. | toileting (use of diapers or liners any incontinence of bowel or urine) |

5. | You want to mention if the client needs reminder, prompting/cueing to perform any of the tasks indicated above). For example, the client can get into the bath tub, but does not wash himself properly, leaves soap in his/her hair if you do not assist him, can’t regulate temperature of the water, needs to be reminded etc. (Not sure if this applies etc.) |

At the end of the evaluation, the nurse will tell you if you passed the “test” (meaning that you were found eligible for MLTC enrollment). The nurse will also ask you if you have selected an MLTC plan for the next evaluation. If you know the name of the MLTC plan, tell the nurse and then the nurse can help you arrange the second evaluation with the MLTC plan of your choice. (better to have a plan in mind, but not required)

If you do not have an MLTC plan in mind, then you can call back the CFEEC 1-855-222-8350 and they can advise you on which plans to contact for evaluations. There are many plans so it is not feasible to call all of them. You may also call the MLTC plans directly.

Resources for Additional Information on CFEEC:

| • | New York Health Access http://www.wnylc.com/health/news/41/ |

| • | NYS Department of Health http://www.health.ny.gov/health_care/medicaid/redesign/mrt_90.htm |

| • | New York Medicaid Choice https://nymedicaidchoice.com/ask/do-i-qualify-managed-long-term-care |

====== 185 ======

PART 2: MLTC Evaluation:

(only after CFEEC says you were found eligible for MLTC enrollment)

The second evaluation is conducted by one or more MLTC plans. You can schedule multiple appointments with different MLTC plans. The reason why you would have more than one plan evaluate you is because you want to ensure that you enroll in an MLTC plan that approves you for the services that you need. You have no obligation to sign enrollment paperwork with the MLTC plan at the time of the evaluation. You can shop around until you choose a plan that meets your needs.

We recommend that you enroll with the first MLTC plan that visits your client:

1. | if this plan approves your client for the hours that he/she needs and |

2. | if your client receives dental, audiology, podiatry, and/or optometry services, then make sure that the MLTC plan you choose has the client’s providers within its network |

We see no reason to shop around if you were approved for the hours/services you were requesting and as applicable, if the MLTC plan works with your providers within those specialties. Remember that you would like to be enrolled in an MLTC as soon as possible so that you can begin to receive long term care services.

You must be enrolled and the plan must submit your enrollment paperwork by the 19th of the month for services to start on the 1st of the following month.

The MLTC evaluation will also be like the evaluation conducted by the CFEEC. You will have to provide the MLTC plan nurse with your health insurance cards, medications, and information about your physician. You will also have to highlight and discuss with the MLTC plan’s nurse the ADL needs of your client (see above section on ADL needs, page #2).

Additional Resources:

| • | Here is a list of MLTC plans http://www.wnylc.com/health/entry/114/#List%20of%20Plans |

| • | Services provided by the MLTC plan http://www.wnylc.com/health/entry/114/#MLTC%20service%20package |

====== 187 ======

====== 189 ======

====== 191 ======

====== 193 ======

====== 195 ======

| What is MLTC? |

MLTC stands for Managed Long Term Care.

Long term care means services that help you with your daily activities. Examples are home care attendants, day care programs, and nursing homes. You might need long term care services if you need another person to help you clean your home, get dressed, or take a shower.

Many New Yorkers who need long term care get it through Medicaid. And most people with Medicaid must get their long term care through an MLTC program.

The “M” in MLTC stands for managed. MLTC is a type of health insurance called managed care. You must join a plan offered by a private health insurance company to get Medicaid to pay for your long term care. Medicaid pays these companies to provide long term care to their members.

In order for the plan to pay for your care, you must go to providers in the plan’s network.

====== 196 ======

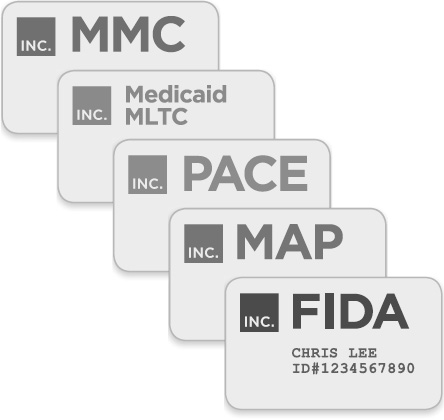

All of the five MLTC programs described below cover services like home care, adult day care, nursing home care, medical supplies, and transportation services. However, availability of other long term care services varies among the five programs.

When you join an MLTC plan, you will get a Care Manager. This person will visit you at least twice a year and help you get the care you need. You can call your care manager whenever you have questions or problems. |

====== 197 ======

| What kinds of MLTC plans are there? |

There are five different kinds of Medicaid health insurance that include long term care. Each kind of plan may cover different services. But all plans of the same kind must cover the same services. Which kind is right for you depends on whether you also have Medicare.

====== 198 ======

If you have Medicaid but don’t have Medicare:

you probably get your Medicaid health insurance through a Mainstream Medicaid Managed Care (MMC) plan.

Mainstream Medicaid Managed Care (MMC)

These plans cover all of your doctors, hospitals, medications, and also your long term care services. You generally do not need a separate MLTC plan to get long term care services.

If you have Medicaid only and need long term care, the rest of this brochure does not apply to you. Call ICAN for help (see p.18).

====== 199 ======

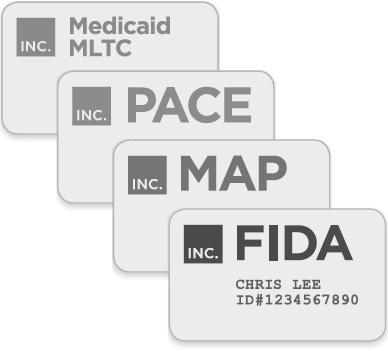

If you have Medicare and Medicaid:

then you can choose from the following four kinds of plan:

====== 200 ======

Medicaid MLTC

Most people with MLTC have this kind of plan, also called “partial-capitation MLTC.” It is called “partial” because it only covers part of your health care.

You would still have traditional Medicare and Medicaid for your doctors, hospitals, and other medical care.

Medicaid MLTC plans cover long term care and a few other services. With this type of plan, you would use your Medicare health insurance for your medical care. You could continue to see the same doctors you see now, because your Medicare health insurance would not change.

====== 201 ======

Here are some of the services covered by Medicaid MLTC:

| • | Home care (including personal care, home health aide, and Consumer Directed Personal Assistance) |

| • | Adult day care |

| • | Private duty nursing |

| • | Physical/Occupational/Speech therapy |

| • | Transportation to medical appointments |

| • | Home delivered meals |

| • | Medical equipment and supplies |

| • | Hearing aids and audiology |

| • | Eyeglasses and vision care |

| • | Dental care |

| • | Podiatry |

| • | Nursing home |

====== 202 ======

Fully-Capitated Plans The following three types of plan include all of the same services as Medicaid MLTC. But they also include all of your Medicare benefits. They are sometimes called fully-capitated plans, because they are paid to provide both your Medicare and Medicaid benefits. With these plans, you would no longer use your Medicare card to get medical care. Everything would be through your plan. These plans are more convenient because you have only one insurance plan to worry about. However, you need to make sure your doctors take the plan before you join. You also need to make sure that the hospitals, pharmacies, and other providers you use are in the plan’s network. If your provider is not in the plan’s network, then your insurance will not pay for you to see them.

|

====== 203 ======

Program of All-Inclusive Care for the Elderly (PACE)

PACE combines Medicare, Medicaid and long term care services under one plan.

You have to be at least 55 years old to join PACE.

If you join a PACE, you must go to a center in your neighborhood to get most of your care.

The PACE center includes doctors and nurses who coordinate your care, as well as adult day care, meals, and other services.

PACE is not available everywhere in the State. But it is a great option for people who live near a PACE center.

====== 204 ======

Medicaid Advantage Plus (MAP)

Medicaid Advantage Plus is like a Medicare Advantage1 plan combined with an MLTC plan. Like PACE, MAP includes all Medicare, Medicaid and long term care services.

Age requirements vary among plans from 18+ to 65+.

Unlike PACE, there is no center you need to go to for your doctors and other care.

====== 205 ======

Fully Integrated Duals Advantage (FIDA)

FIDA is a new type of health insurance that provides better coordination for people with Medicare and Medicaid.

Like PACE and MAP, FIDA combines all of your Medicare, Medicaid and long term care services into one plan.

In FIDA, you would be part of a team that can help you make decisions about your health care. Depending on your personal preferences, this team can include any family members or friends who help you, your doctor, and your care manager at the plan.

This team helps get you the services you need and makes sure all the parts of your health care are working together smoothly.

====== 206 ======

FIDA also covers some special services, like home modifications, non-medical transportation, house calls by doctors, and services to help you move out of a nursing home into the community.

Some FIDA plans even give you a card you can use to buy over-the-counter items from the drug store.

If you want to have your Medicare and Medicaid benefits combined, FIDA is probably your best option.

FIDA is only available in New York City, Nassau, Suffolk, and Westchester.2

To learn more about FIDA, see our brochure called “Is FIDA right for me?”

There is also a special FIDA plan for people with intellectual or developmental disabilities, called FIDA-IDD. To learn more, see our brochure called “A Plan for Me: FIDA-IDD.”

====== 207 ======

| Who must join an MLTC plan? |

You must join a Plan if you answer “yes” to all of these questions:

Are you currently enrolled in Medicare? | □ yes | □ no |

Are you currently enrolled in Medicaid? | □ yes | □ no |

Do you need long-term home care, adult day health care, nursing home, or other long term care? | □ yes | □ no |

Are you age 21 or older? | □ yes | □ no |

If you answered “yes” to all of the questions, then you must choose a plan.3 You can choose a Medicaid MLTC, PACE, MAP or FIDA plan.

You will only be able to receive long term care services by joining a plan.

If you are already receiving Medicaid long term care services, you may already have been switched into an MLTC plan.

If you are applying for Medicaid long term care, you must choose an MLTC plan once you are approved for Medicaid.

====== 208 ======

| ICAN can help you. |

We can:

| • | Answer your questions about Managed Long Term Care plans. |

| • | Give you advice about your plan options. |

| • | Help you enroll in an MLTC plan. |

| • | Identify and solve problems with your plan. |

| • | Help you understand your rights. |

| • | Help you file complaints and/or grievances if you are upset with a plan’s action. |

| • | Help you appeal an action you disagree with. |

Call 844-614-8800. If you are hearing or speech impaired, you can use the NY Relay service by dialing 711. Email ICAN@cssny.org. |

====== 209 ======

====== 211 ======

|

|

633 Third Ave. | (844) 614-8800 |

ICAN is a program of Community Service Society of New York, funded by New York State. The opinions, results, findings and/or interpretations of data contained in this brochure are the responsibility of CSS and do not necessarily represent the opinions, interpretations or policy of the State. Design by Imaginary Office. Updated July 2016.

====== 213 ======

December 15, 2016

Temporary Non-Immigrants |

The following ALERT is to advise Hospitals, Community Based organizations and Providers of instructions received from New York State in Administrative directive 16 MA-002, Changes in Medicaid Coverage for Temporary Non-Immigrants. These changes are effective immediately.

Temporary non-immigrants are individuals who are allowed to enter the United States temporarily for a specific purpose and for a specific period of time. They are commonly referred to as short-term visa holders (e.g., tourists, students and visitors for the purpose of business). MAP-3123, Residency Review Worksheet has been created for use in determining whether or not a Temporary Non-Immigrant has met the SDOH-defined residency requirement for full Medicaid evaluation.

Prior to this recent change in State policy, Temporary Non-Immigrants could only be evaluated for Treatment of Emergency Medical Condition (07 Coverage). However, based upon new policy, these individuals may now be eligible for full Medicaid coverage if they have established residency.

Effective immediately, as a condition of Medicaid eligibility, Temporary Non-Immigrants are required to complete and return the attached MAP-3123, along with any documentation required as a result of the responses that they provided. If an application for someone meeting this criteria is received without this form, staff will defer applications and renewal applications for these non-immigrants who fail to complete MAP-3123. At renewal, all consumers with 07 coverage will be deferred for completion of MAP-3123 to ensure that recipients who only have coverage for emergency services are given the opportunity complete the Residency Review Worksheet and be evaluated for additional coverage.

Consumers will be given 15 days to provide proof of residency pursuant to the answers they provided on the MAP-3123. If they fail to return the MAP-3123 in response to the deferral notice, the case will be denied or closed for failure to respond.

Consumers returning completed MAP-3123 forms with “No” responses to all questions will be deemed as failing the New York State Residency test and are eligible only for evaluation for Emergency Medicaid (07 Coverage).

PLEASE SHARE THIS ALERT WITH ALL APPROPRIATE STAFF

NYC Medicaid Alerts are a Periodic Service of the NYC Human Resources Administration

Medical Assistance Program • Office of Eligibility Information Services • 785 Atlantic Avenue, Brooklyn, NY 11238

Steven Banks, Commissioner ♦ Karen Lane, Executive Deputy Commissioner ♦ Maria Ortiz-Quezada, Director of EIS

Copyright 2016 The City of New York, Department of Social Services.

For permission to reproduce all or part of this material contact the New York City Human Resources Administration

====== 215 ======

October 21, 2016

Clarification on Institutional Medicaid for PRUCOL Individuals |

An individual’s status as “PRUCOL” should not be used as a factor in determining the need for nursing home services nor in nursing home admittance. The term “Permanently Residing Under the Color of Law” (PRUCOL) is a public benefit eligibility status.

HRA determines an individual’s PRUCOL eligibility as part of the Medicaid eligibility process. An individual, otherwise eligible and determined to be PRUCOL, is eligible for Medicaid regardless of level of service or the category of assistance. MAGI and non-MAGI individuals determined to be PRUCOL are eligible for the same Medicaid coverage as citizens.

Eligible PRUCOL individuals will receive Medicaid coverage for all care and services including long term nursing home care. In addition, lack of a green card or social security number is not a basis to deny admittance to a nursing home or long term care services. Admittance to a nursing home or long term care services must be based on need and Medicaid eligibility, not immigration status.

NYC Medicaid Alerts are a Periodic Service of the NYC Human Resources Administration

Medical Assistance Program• Office of Eligibility Information Services • 785 Atlantic Avenue, Brooklyn, NY 11238

Steven Banks, Commissioner ♦ Karen Lane, Executive Deputy Commissioner ♦Maria Ortiz-Quezada, Director of EIS

Copyright 2016 The City of New York, Department of Social Services.

For permission to reproduce all or part of this material contact the New York City Human Resources Administration.

====== 216 ======

PLEASE SHARE THIS ALERT WITH ALL APPROPRIATE STAFF

====== 217 ======

September 23, 2016

Submission of Foreign Passports to Determine Immigrant Eligibility |

When submitting copies of foreign passports as proof of immigration status for any consumer who is not a U.S. citizen, it is very important that you include copies of all pages with any markings: passport stamps, Visas, annotations, etc. This information is needed to properly determine Medicaid eligibility. HRA will review all markings in foreign passports to make an immigrant eligibility determination.

When copying pages of a foreign passport, please pay particular attention to the copy/scanning quality. Stamp on foreign passports are often difficult to copy. It may be necessary to choose the darken option on the copier to ensure the information is readable.

PLEASE SHARE THIS ALERT WITH ALL APPROPRIATE STAFF

NYC Medicaid Alerts are a Periodic Service of the NYC Human Resources Administration

Medical Assistance Program• Office of Eligibility Information Services • 785 Atlantic Avenue, Brooklyn, NY 11238

Steven Banks, Commissioner ♦ Karen Lane, Executive Deputy Commissioner ♦Maria Ortiz-Quezada, Director of EIS

Copyright 2016 The City of New York, Department of Social Services.

For permission to reproduce all or part of this material contact the New York City Human Resources Administration.

====== 219 ======

November 23, 2016

Applying for Entitlement and Benefits |

This Alert is to inform Client Representatives, Providers, Hospitals, Managed Long Term Care (MLTC) Plans, Nursing Homes of instructions provided by New York State of Health in GIS 16 MA/12 regarding entitlements or other benefits for which an applicant/recipient may reasonably appear to be eligible, but for which s/he has not applied.

Applicants/recipients (A/Rs) who are eligible for or reasonably appear to meet the eligibility criteria for an entitlement benefit which would reduce or eliminate the need for assistance and care, are required to apply for and fully utilize such benefits as a condition of Medicaid eligibility. Entitlement benefits include Unemployment Insurance Benefits (UIB), Social Security Retirement, and Survivors and Disability Insurance (RSDI). For example, if someone has zero income ($0.00) but also discloses that s/he has a work history and recently lost a job, requiring the A/R to apply for UIB would be appropriate. If an A/R indicates zero income and s/he is disabled and unable to work and has a work history, applying for Social Security Disability benefits would be an appropriate referral.

With the increase in the retirement age for full Social Security retirement benefits, many individuals are delaying retirement and continue to work full time. When an A/R is still working full time, they are not required to apply for Social Security Retirement benefits as a condition of eligibility. However, if an A/R is not working full-time, they are required to apply when they become eligible at age 62. A/R’s can attest whether s/he works part-time or full-time. This policy is applicable to all Medicaid programs.

PLEASE SHARE THIS ALERT WITH ALL APPROPRIATE STAFF

NYC Medicaid Alerts are a Periodic Service of the NYC Human Resources Administration

Medical Assistance Program • Office of Eligibility Information Services • 785 Atlantic Avenue, Brooklyn, NY 11238

Steven Banks, Commissioner ♦ Karen Lane, Executive Deputy Commissioner ♦ Maria Ortiz-Quezada, Director of EIS

Copyright 2016 The City of New York, Department of Social Services.

For permission to reproduce all or part of this material contact the New York City Human Resources Administration

====== 221 ======

October 19, 2016

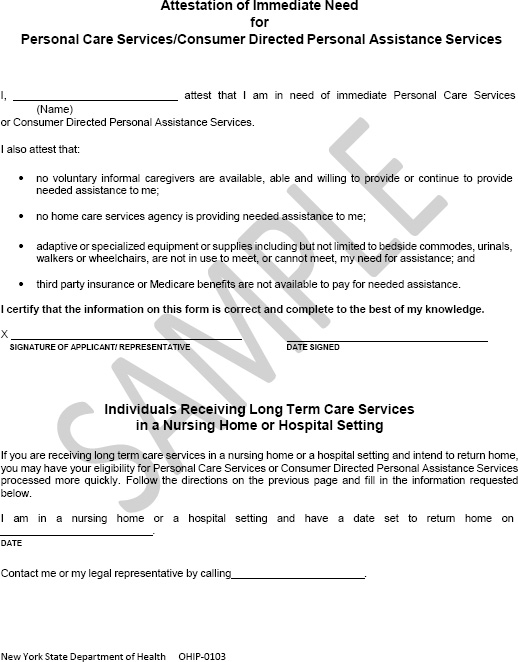

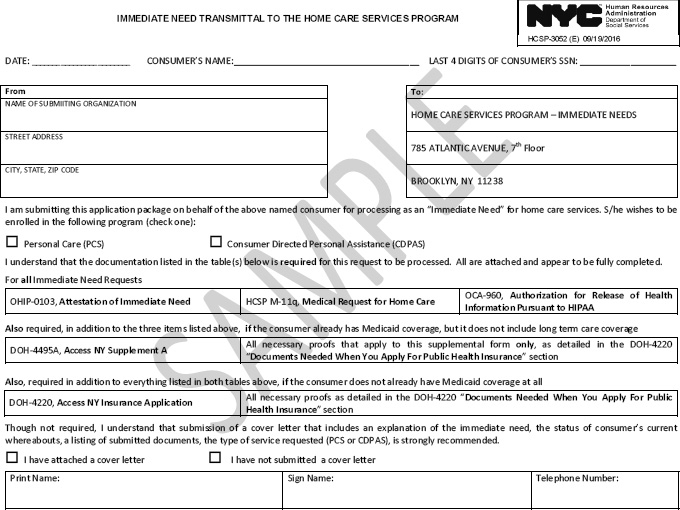

Immediate Need for Personal Care or Consumer Directed Personal Assistance Services |

The purpose of this Alert is to inform Medicaid providers, community based organizations and others assisting Medicaid clients of the procedure for requesting Immediate Need Personal Care or Consumer Directed Personal Assistance Services.

| I. Consumer with Immediate Need for Home Care Services |

In order to be considered a consumer with an Immediate Need for Home Care Services, the consumer must meet the following conditions:

a. | Have an immediate need for Personal Care or Consumer Directed Personal Assistance Services; |

b. | Have no informal caregivers available, able or willing to provide personal care services; |

c. | Have no home care agency providing needed assistance; |

d. | Does not have third party insurance or Medicare benefits available to pay for needed assistance; |

e. | Does not have adaptive or specialized equipment or supplies in use to meet, or has adaptive or specialized equipment or supplies that cannot meet, the person’s need for assistance. |

A consumer must attest to meeting these conditions by completing and signing the OHIP-0103, Immediate Need for Personal Care Services/Consumer Directed Personal Care Services: Informational Notice and Attestation Form.

| II. Submission of an Immediate Needs Request |

A new transmittal, HCSP-3052, Immediate Need Transmittal to the Home Care Services Program has been developed to facilitate Immediate Needs Requests. Required documents vary depending on whether or not the consumer is already in receipt of Medicaid with coverage for long term care, needs

====== 222 ======

All consumers:

Consumers with active Medicaid coverage that needs to be upgraded to include community based long term care, also must submit:

* Note: For purposes of the eligibility determination, a consumer who would otherwise be required to document his or her accumulated resources may attest to the current value of any real property and to the current dollar amount of any bank accounts. Consumers without active Medicaid also must submit:

* Note: For purposes of the eligibility determination, a consumer who would otherwise be required to document his or her accumulated resources may attest to the current value of any real property and to the current dollar amount of any bank accounts. Consumers with Medicaid coverage on the Health Exchange (NY State of Health): The consumer/representative must contact NY State of Health (855-355-5777 or via email (hxfacility@health.ny.us) to have the Medicaid transferred to HRA. For these consumers the OHIP-0103, Immediate Need for Personal Care Services/Consumer Directed Personal Care Services: Informational Notice and Attestation Form and the M-11Q, Medical Request for Home Care or physician’s order for personal care, must be sent to HRA. ====== 223 ====== Where to Submit

|

| III. Processing of Immediate Needs Cases: |

The Immediate Need Request packages are logged in and date stamped to establish date of receipt. The expedited processing begins the first calendar day after receipt of the documents. The first calendar day will be referred to as day one (1).

Medicaid Determination

1. | Within four (4) calendar days after day one (1), the HCSP Medicaid Eligibility Unit (MEU) will review the submitted documents for completeness to determine if a Medicaid eligibility review can proceed.

|

Service Authorization Review

1. | On day one (1), the Medical Request for Home Care (M11-q) and cover letter, if applicable, will be scanned and registered in the Long Term Care Web (LTCW) system and reviewed for completeness, accuracy and compliance with NYSDOH regulations. |

2. | Concurrently, the process of scheduling a home visit will be initiated upon verification of a complete Medicaid Application or conversion request for Medicaid with coverage for Long Term Care. |

====== 224 ====== | |

3. | If the HCSP-M11q is found to be complete, accurate and compliant with regulations, a home visit with the applicant will be scheduled. The service authorization review will be completed prior to the twelfth (12th) day from day four. |

4. | If the HCSP-M11q is found to be incomplete, not accurate or non-compliant with regulations, it will be rejected. A written notice will be sent to the applicant / family / representative stating the reason for the HCSP M11q’s rejection. A new Immediate Need request can be submitted with a Attestation form and properly completed M11-q |

5. | If the applicant is approved for services, the case will be assigned by the 12th day from day four to a HRA contracted License Home Care Services Agency or Fiscal Intermediary as appropriate. |

6. | If the applicant is not approved for services, a written notice will be sent to the applicant / representative indicating the reason for denial of services. More information is available in the New York State Department of Health’s ADM: 16 OHIP/ADM-02 Immediate Need for Personal Care Service and Consumer Directed Personal Assistance Services. Please note that in addition to posting the new transmittal (HCSP-3052) and OHIP -0103 forms on MARC, these forms have also been added to HRA’s internet site (Long Term Care) page (http://www1.nyc.gov/site/hra/help/long-term-care.page) to help ensure these forms are readily available. PLEASE SHARE THIS ALERT WITH ALL APPROPRIATE STAFF |

====== 225 ======

====== 226 ======

====== 227 ======

====== 229 ======

====== 230 ======

====== 231 ======

====== 232 ======

====== 233 ======

| 1. | Medicare Advantage is a way to get your Medicare health insurance through a private managed care plan. Some Medicare beneficiaries choose to enroll in these plans. |

| 2. | As of June 2016, FIDA is not yet available in Suffolk and Westchester counties. |

| 3. | There are a small number of exemptions, even if you answered “yes” to all of these questions. Call ICAN at (844) 614-8800 to find out more. |