====== 423 ======

Submitted byKeir D. GumbsCovington & Burling LLP If you find this article helpful, you can learn more about the subject by going to www.pli.edu to view the on demand program or segment for which it was written. |

====== 425 ======

A New Chapter for Non-GAAP FinancialMeasures

June 28, 2016

Securities

The SEC’s Division of Corporation Finance (the “Division”) recently issued updated interpretive guidance on the use of non-GAAP financial measures. This guidance reflects an increasingly assertive position taken by the SEC in recent months regarding public companies’ use of numerical measures of performance, financial position or cash flows that are not calculated in accordance with generally accepted accounting principles (“GAAP”). This renewed focus follows years of use of non-GAAP financial measures by many issuers and recent analyst research and press reports that have raised questions about the discrepancies between such measures and financial performance metrics calculated in accordance with GAAP.1 In response to the perceived misuse of non-GAAP financial measures, SEC Chair Mary Jo White stated in December 2015 that:

[T]he use of non-GAAP financial measures … deserves close attention, both to make sure that our current rules are being followed and to ask whether they are sufficiently robust in light of current market practices. Non-GAAP measures are allowed in order to convey information to investors that the issuer believes is relevant and useful in understanding its performance. By some indications, such as analyst coverage and press commentary, non-GAAP measures are used extensively and, in some instances, may be a source of confusion.2

In addition, in March 2016, the SEC’s Chief Accountant, James V. Schnurr, noted that the SEC had observed “a significant and, in some respects, troubling increase over the past few years in the use of, and nature of adjustments within, non-GAAP measures by companies as well [as]

====== 426 ======

In light of these developments, this is a good time for public companies to review their use of non-GAAP financial measures and related disclosures to ensure that presentations of non-GAAP financial measures are compliant with applicable disclosure requirements. This advisory reviews the regulatory framework governing the use of non-GAAP financial measures and the Division’s recently released guidance and notes certain areas for particular consideration by public companies and their advisors.

| Regulation of Non-GAAP Financial Measures |

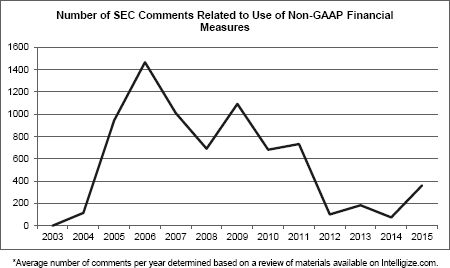

The decade prior to the passage of the Sarbanes-Oxley Act of 2002 witnessed a rising tide of financial measures derived using methods that differed from GAAP.4 These measures provided technology startups and other companies reporting low revenues and high costs with an alternative means to explain their businesses to investors without relying exclusively on traditional GAAP metrics. However, market participants and commentators soon expressed concern regarding the use of non-GAAP financial information due to the lack of a uniform definition of such measures and the risk that such measures could, as a consequence, mislead investors.5 Congress responded to these concerns by instructing the SEC, in Section 401(b) of the Sarbanes-Oxley Act, to adopt rules regulating the use of “pro forma” financial information. In January 2003, the SEC adopted rules in response to this mandate in two main areas.6 First, the SEC added an accounting disclosure regulation, Regulation G, which prohibits the use of non-GAAP financial measures outside of SEC filings without complementary disclosure of the most directly comparable GAAP financial measure and a reconciliation of the two measures.7 Second, the SEC adopted Item 10(e) of Regulation S-K, which requires additional disclosures and imposes certain restrictions regarding the use of non-GAAP financial measures in SEC filings. The SEC also amended Form 8-K to require that earnings releases be furnished to the SEC under Item 2.02 of Form 8-K and that non-GAAP financial measures included in such releases comply with the requirements of Item 10(e) of Regulation S-K. In the early years following the adoption of these rules, the SEC engaged in active oversight of the use of non-GAAP financial measures, primarily through comment letters issued by the Division in its review of public company filings. However, in later years, the number of comments issued by the Division regarding non-GAAP financial measures has decreased from ====== 427 ====== |

Regulation G covers the use of non-GAAP financial measures in any public disclosure, such as press releases, investor calls, CEO letters included in annual reports and other corporate announcements, in two ways.11 First, it sets forth a general anti-fraud rule that a registrant may not make public a non-GAAP financial measure that, in light of any accompanying information and discussion, includes a false statement of material fact or omits a statement or fact needed to render the use of the non-GAAP financial measure not misleading.12 Second, Regulation G requires a specific disclosure framework whenever a registrant publicly discloses material information that includes a non-GAAP financial measure. Under that framework, the registrant must also include:

In general, the reconciliation must be quantitative for both the historical information and any forward-looking information presented. In recognition of the potential difficulty in reconciling forward-looking information, however, Regulation G only requires quantitative reconciliation of such information “to the extent available without unreasonable efforts.” Separately, the registrant must identify what information is not available and disclose its probable significance.14 Regulation G defines a non-GAAP financial measure as a “numerical measure of a registrant’s historical or future financial performance, financial position or cash flow” that either excludes ====== 428 ====== The definition of a non-GAAP financial measure expressly excludes financial and statistical measures calculated using exclusively one or both of (a) financial measures calculated in accordance with GAAP and (b) operating or other measures that are not GAAP financial measures. The definition also excludes financial measures that must be disclosed to satisfy “GAAP, [SEC] rules, or a system of regulation of a government or governmental authority or self-regulatory organization that is applicable to the registrant.”16 Regulation G applies to any entity required to file reports under Section 13(a) or 15(d) of the Securities Exchange Act of 1934, except for registered investment companies.17 |

Item 10(e) of Regulation S-K governs the use of non-GAAP financial measures in SEC filings.18 Item 10(e), which applies to all registrants that make filings with the SEC, except registered investment companies, uses the same definition of non-GAAP financial measure as in Regulation G, but at the same time imposes requirements and prohibitions that are more extensive than those in Regulation G. As with Regulation G, Item 10(e) of Regulation S-K does not cover disclosure of non-GAAP financial measures if the disclosure is part of certain communications regarding business combination transactions. Item 10(e) requires the same complementary and reconciling presentation as is required under Regulation G. Item 10(e) further provides, however, that the presentation of the most directly comparable GAAP measure must be of equal or greater prominence than the corresponding non-GAAP financial measure. In addition, Item 10(e) provides that a registrant must include a statement detailing why its management believes each non-GAAP financial measure is useful to ====== 429 ====== Furthermore, Item 10(e) prohibits companies from disclosing non-GAAP financial measures that:

|

| SEC Guidance: New and Revised Compliance and Disclosure Interpretations |

On May 17, 2016, the SEC’s Division of Corporation Finance issued new and revised compliance and disclosure interpretations regarding the use of non-GAAP financial measures. The discussion that follows summarizes a number of key topics addressed by the updated Non-GAAP C&DIs.

Section 100 of the Non-GAAP C&DIs covers several potentially misleading uses of non-GAAP financial measures. The guidance in this section is reflective of the Division’s renewed focus on preventing the use of potentially misleading non-GAAP financial measures. Between January 1, 2015 and May 31, 2016, we estimate that approximately 15 percent of comments issued by the ====== 430 ======

|

Under Item 10(e) of Regulation S-K, when a registrant presents a non-GAAP financial measure, it must present the most directly comparable GAAP financial measure with “equal or greater prominence.” Between January 1, 2015 and May 31, 2016, we see that approximately 25 percent of comments issued by the Division regarding non-GAAP financial measures addressed this requirement. The revised guidance provides an expansive and largely formulaic reading of “equal or greater prominence.” Although conceding that “whether a non-GAAP measure is more prominent than the comparable GAAP measure generally depends on the facts and circumstances in which the disclosure is made,” in the Non-GAAP C&DIs the Division provides eight examples of presentations that would not comply with the “equal or greater prominence rule.”30 Many of these examples effectively require that the corresponding GAAP financial measure be given greater prominence than the non-GAAP financial measure, rather than just equal prominence. The Division considers the following examples to be non-compliant:

While bordering on a “form over substance” litany of disclosure peeves, this explication of the “greater or equal prominence” requirement of Item 10(e) is an indication of a growing impatience by the Division with practices, largely in earnings releases, investor presentations and proxy statements, which have skirted the disclosure principles of Item 10(e).31 This will likely be a focus of the Division in its review of filings and related materials going forward, and some of the examples provided in the guidance may cause companies to depart from past practices in order to avoid the receipt of comments addressing the prominence of non-GAAP financial measures in their earnings releases and/or other SEC filings. | |||||||||||||||||||||

EBIT and EBITDA are non-GAAP financial measures that can be used both to indicate a company’s liquidity as well as its operating performance.32 As noted above, Item 10(e) of Regulation S-K prohibits registrants from excluding charges or liabilities that required, or will require, cash settlement, or would have required cash settlement absent an ability to settle in another manner, from non-GAAP liquidity measures, other than EBIT and EBITDA.33 Measures that are calculated differently from EBIT and EBITDA do not fall under the exception provided for in Item 10(e) and are generally impermissible when used as a liquidity measure. In certain cases, however, disclosure of such measures may nonetheless be appropriate.34 Such measures should not be characterized as EBIT or EBITDA, but rather should have titles that distinguish them from EBIT or EBITDA (for example, “Adjusted EBITDA”).35 ====== 433 ====== A common area for Division comments on non-GAAP financial measures involves the reconciliation of those non-GAAP measures to the comparable GAAP measure, including incorrect EBIT or EBITDA reconciliation.36 Companies should continue to carefully review their processes for reconciliation of non-GAAP financial measures to the most directly comparable GAAP measure, particularly when reconciling EBIT or EBITDA. If EBIT or EBITDA is presented as a performance measure, such measure should be reconciled to net income as presented in the statement of operations under GAAP. In this case, the Division has clarified that reconciling to operating income is inappropriate because EBIT and EBITDA make adjustments for items that are not included in operating income.37 |

The use of per share non-GAAP financial measures is not specifically prohibited under Item 10(e)(1)(ii) of Regulation S-K, and, in the revised guidance the Division clarifies that certain uses of non-GAAP earnings per share numbers are acceptable because certain non-GAAP per share performance measures may be meaningful from an operating standpoint.38 On the other hand, the revised guidance goes on to confirm the Division’s long-established position that liquidity measures may generally not be presented on a per share basis in SEC filings.39 In general, non-GAAP financial measures that report on cash or funds generated from operations (such as free cash flow) or that are capable of doing so (such as EBIT and EBITDA) are considered liquidity measures for purposes of the prohibition on presenting liquidity measures on a per share basis.40 Non-GAAP performance measures that are presented on a per share basis are still considered acceptable by the Division and should be presented with, and reconciled to, net income, or income from continuing operations, taken from the statement of operations. When determining whether per share data constitutes a liquidity measure or a performance measure, the Division indicated that it will focus on the substance of the non-GAAP measure rather than management’s characterization thereof.41 |

====== 434 ======

The guidance states that a registrant may need to provide information regarding income tax effects on its non-GAAP financial measures depending on the nature of the measures used.42 If the registrant is using a non-GAAP liquidity measure that includes income taxes, it may be appropriate to adjust GAAP taxes to show taxes paid in cash. In the case of a performance measure, the registrant should include current and deferred income tax expense commensurate with the non-GAAP measure of profitability. In addition, the Division’s guidance makes it clear that adjustments made to arrive at a non-GAAP measure should not be presented as “net of tax”; rather they should be shown as a separate adjustment and clearly explained. |

| Takeaways |

The SEC has made it clear that there will be an increase in the number of SEC comments related to non-GAAP financial measures, at least in the near term, and the Division is already issuing comments based on the new guidance. In particular, it appears that the SEC will focus its efforts to address the use of potentially misleading non-GAAP financial measures, the prominence of non-GAAP financial measures as compared to GAAP measures, and the use of certain unacceptable per share measures. In addition, it is certainly possible that there could be more activity by the SEC’s Division of Enforcement in connection with possible improper use of non-GAAP financial measures, likely focusing on measures that are misleading.43

In light of increased scrutiny regarding the use of non-GAAP financial measures, companies should:

We expect the Division to continue to heighten its focus on non-GAAP financial measure disclosures, which will surely increase the number of Division comments in this area. However, the hope is that the Division will allow companies to self-correct, at least initially, and not challenge companies on some of these issues without giving companies time to think about their non-GAAP financial disclosures and reflect the necessary changes in future filings, earnings releases and presentations. ====== 436 ====== If you have any questions concerning the material discussed in this client alert, please contact the following members of our Securities practice group: Ashley Angelotti, a summer associate and law student at the University of Virginia School of Law, contributed to this client alert. This information is not intended as legal advice. Readers should seek specific legal advice before acting with regard to the subjects mentioned herein. Covington & Burling LLP, an international law firm, provides corporate, litigation and regulatory expertise to enable clients to achieve their goals. This communication is intended to bring relevant developments to our clients and other interested colleagues. Please send an email to unsubscribe@cov.com if you do not wish to receive future emails or electronic alerts. | |||||||||||||||||||||||||||

====== 437 ======

| Appendix A |